Need steady income during retirement? Immediate annuities might be the answer. These financial products turn a lump sum into regular payments that start within 30 days to 12 months, offering retirees predictable income for life or a set period. Here’s what you need to know:

- What they are: A one-time payment to an insurer that provides regular income.

- Why consider them: Guaranteed payments reduce the risk of outliving savings and simplify budgeting.

- Key features: Fixed payment schedules (monthly, quarterly, or annual), lifetime or period-specific payouts, and tax advantages when purchased with after-tax dollars.

- Pros: Steady income, no market risk, and ease of management.

- Cons: Limited liquidity, no growth potential, inflation concerns, and reduced inheritance options.

Immediate annuities work best when paired with other retirement income sources like Social Security or investments. Before committing, ensure you have emergency savings, understand the costs, and consult a licensed professional to align this option with your financial goals.

Key Factors to Review Before Buying

Costs and Fees

Understanding the costs involved is crucial when considering an immediate annuity. These fees directly impact the income you’ll receive. For instance, agent commissions are typically included in the payout calculations, which means a smaller portion of your premium is converted into income. On top of that, you may encounter state premium taxes, administrative fees, and the opportunity cost of having your capital tied up, all of which can further reduce your overall income.

Take the time to assess these expenses carefully to ensure an immediate annuity aligns with your retirement income goals.

Single Premium Immediate Annuity – Here Are the Pros and Cons

Income Stream Options

Immediate annuities come with various payment options, allowing retirees to align their income with their specific financial needs and spending habits.

Payment Frequency and Duration

When it comes to payment schedules, you can decide how often you’d like to receive income from your annuity. The most common choices are monthly, quarterly, or annual payments, with monthly being the go-to option for many retirees. This flexibility makes it easier to sync your income with your regular expenses.

- Monthly payments are ideal for covering recurring costs like rent or mortgage, groceries, and utility bills.

- Quarterly payments can work for those who prefer fewer but larger deposits to handle bigger or seasonal expenses.

- Annual payments are a good fit if you’d rather receive a lump sum once a year for specific goals or larger financial needs.

Importantly, while the frequency of payments doesn’t change your total annual income, some providers offer a feature called payment acceleration. This allows you to receive several months’ worth of income upfront, which can be helpful for unexpected expenses or significant purchases.

As for duration, you have options like lifetime payments, which guarantee income for as long as you live, or period-certain payouts, where payments are guaranteed for a set number of years, such as 10 or 20. This choice depends on your financial goals and how long you want the income to last.

sbb-itb-f98a391

Pros and Cons of Immediate Annuities

Immediate annuities come with both benefits and drawbacks that can shape your retirement income strategy. Before making a decision, it’s crucial to weigh these factors carefully.

Advantages of Immediate Annuities

The biggest advantage of immediate annuities is the assurance of receiving guaranteed income for life. Once purchased, you’ll get regular payments regardless of how the market performs, economic shifts, or how long you live. This safeguard against longevity risk ensures you won’t run out of money, even if you live well past the average life expectancy.

Another appealing feature is their simplicity. After making your initial payment, there’s no need to worry about managing investments, rebalancing portfolios, or deciding how much to withdraw. Payments arrive on a set schedule, freeing you from the stress of overseeing your retirement funds.

Immediate annuities also provide stable income, unaffected by market fluctuations. Unlike a 401(k) or IRA, which can rise and fall with the stock market, your annuity payments remain consistent. This stability can be especially comforting during times of economic uncertainty.

The predictability of fixed payments makes budgeting easier. Knowing exactly how much you’ll receive each month helps prevent overspending early in retirement, a common concern for retirees.

Disadvantages of Immediate Annuities

One major downside is the lack of liquidity. Once your money is invested, you can’t access it for emergencies or unexpected expenses. This can be a drawback if your financial situation changes or if you need funds for unforeseen circumstances.

Immediate annuities also have limited growth potential. Unlike investments tied to the stock market, they don’t benefit from market gains. During strong economic periods, this can mean missing out on significant returns.

Another concern is inflation erosion. Unless you purchase inflation protection – which comes at an additional cost and lowers your initial payments – your fixed income may lose purchasing power over time. What seems sufficient today might not cover your needs 20 or 30 years down the road.

If you choose a lifetime-only option, there’s also no inheritance for your heirs. If you pass away shortly after buying the annuity, the remaining funds go to the insurance company instead of your loved ones. While you can add survivor benefits, these reduce your monthly income.

Finally, there’s credit risk to consider. Your payments depend on the financial health of the insurance company. If the insurer faces financial trouble, your income could be at risk. However, state guarantee associations offer some protection, though it’s limited.

Comparison Table of Pros and Cons

| Advantages | Disadvantages |

|---|---|

| Guaranteed lifetime income | No access to principal once invested |

| Protection from market swings | Limited growth potential |

| Simple and stress-free | Inflation reduces purchasing power |

| Fixed payments for budgeting | No inheritance for heirs (lifetime option) |

| Longevity risk protection | Dependent on insurer’s stability |

| Immediate, steady income | Miss out on market gains |

Immediate annuities work best as part of a diversified retirement plan rather than being your sole income source. They’re ideal for creating a reliable base of guaranteed income, while other investments can provide growth and liquidity for unexpected needs. Understanding these pros and cons will help you decide if an immediate annuity aligns with your retirement goals.

Checklist for Determining Suitability

After weighing the pros, cons, and potential income options, use this checklist to decide if an immediate annuity aligns with your retirement needs. It’s important to evaluate how an immediate annuity fits into your overall financial strategy.

Questions to Ask Yourself

Start by assessing your financial situation and retirement priorities. Make sure you have three to six months of emergency savings readily available before committing any funds.

- What are your other income sources? If Social Security, pensions, or part-time work already cover your essential living expenses, an immediate annuity could serve as additional security. On the other hand, if you’re facing a significant income gap, it might help fill that void.

- How’s your health and family history? Immediate annuities tend to be more beneficial for those with longer life expectancies. If you’re in good health and longevity runs in your family, the lifetime income guarantee becomes particularly appealing. However, if you have serious health concerns, you may want to explore more flexible options that could benefit your heirs.

- What’s your risk tolerance? If market volatility makes you uneasy or keeps you up at night, the predictable payments of an immediate annuity can offer peace of mind. But if you’re comfortable with some market risk in exchange for potential growth, you might prefer sticking with traditional investments.

- Do you have enough liquidity? Once funds are committed to an annuity, they’re not easily accessible. Ensure you have enough accessible assets to cover long-term care, home modifications, or unexpected emergencies.

- What are your inheritance goals? If leaving a substantial inheritance is a priority, lifetime-only annuities may not align with your objectives. However, if your primary concern is ensuring financial stability and avoiding becoming a burden on your family, the guaranteed income from an annuity might better suit your goals.

After reflecting on these questions, consider consulting with a licensed professional for personalized advice.

Consulting a Licensed Professional

A licensed annuity professional can guide you through the complexities of immediate annuities and help you make informed decisions. These experts will take a close look at your entire financial picture, including your retirement accounts, Social Security benefits, pension payments, and other assets, to determine how an immediate annuity fits into your broader strategy.

They’ll also explain the various payout options available, helping you understand how each choice impacts your monthly income and benefits for your spouse or heirs. Additionally, they can clarify the tax implications of your annuity purchase, whether you’re using qualified retirement funds or after-tax dollars. This professional insight ensures your annuity aligns with your overall retirement income plan.

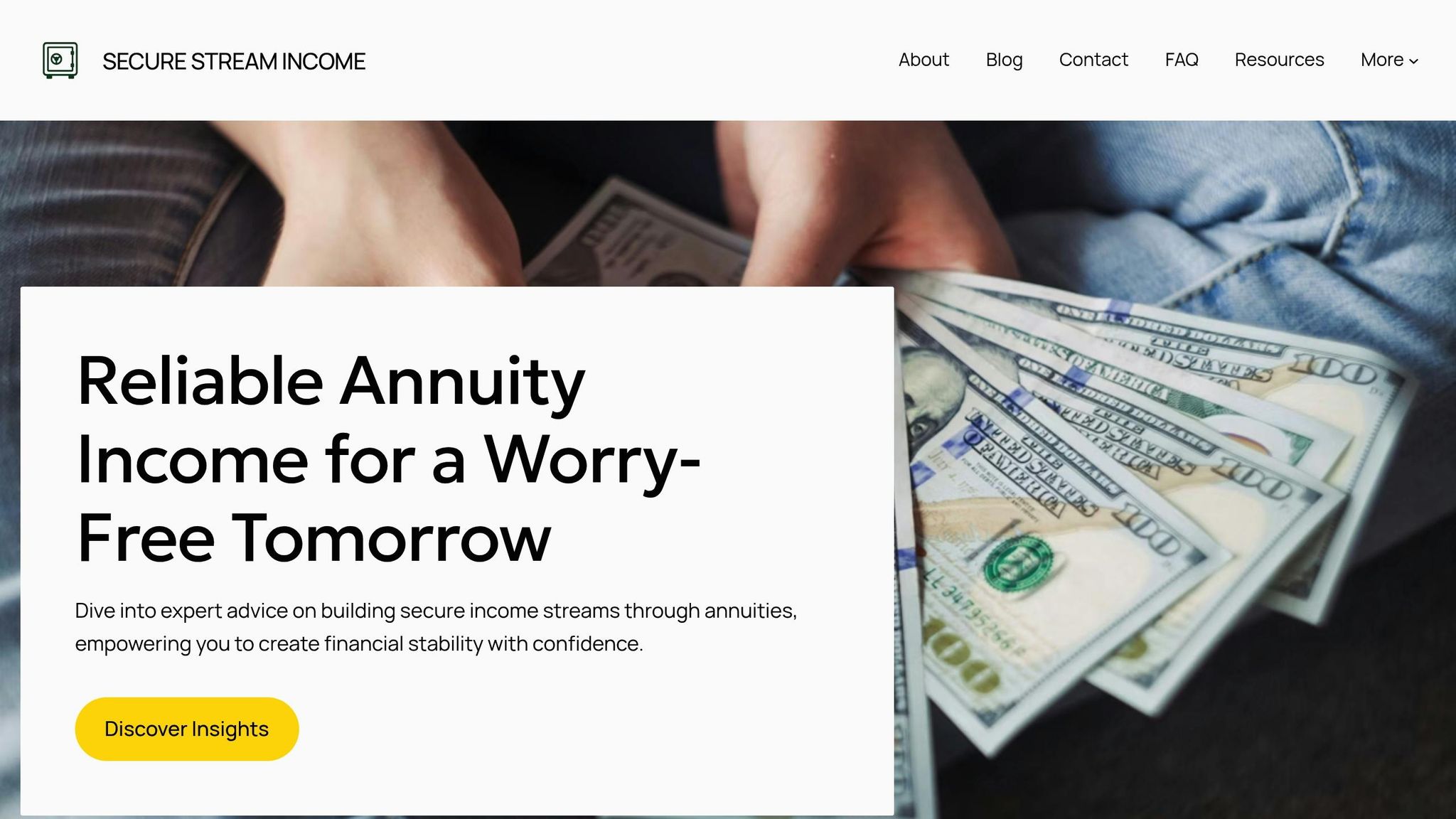

Secure Stream Income as a Resource

For those seeking clear guidance, Secure Stream Income provides resources and tools to simplify the process of understanding and planning for immediate annuities. Their educational materials break down complex concepts into plain language, so you can grasp the essentials without feeling overwhelmed by technical terms or sales pitches.

Through Secure Stream Income, you’ll have access to a network of licensed insurance agents across the country. These professionals are familiar with local regulations and market conditions, offering tailored advice based on your unique financial situation and retirement goals.

The platform also empowers you to ask the right questions when meeting with advisors. By understanding the basics ahead of time, you’ll be better equipped to evaluate recommendations and make confident decisions about your retirement income.

Secure Stream Income’s resources go beyond just annuities. They help you see how an immediate annuity fits into a larger financial plan, working alongside Social Security, retirement accounts, and other income sources to create a stable and balanced retirement strategy.

Making an Informed Decision

Choosing an immediate annuity is a big step, and it’s important to weigh how it fits into your overall financial picture and retirement goals. Think about how it works alongside Social Security, pensions, and other income streams.

Key Takeaways

An immediate annuity provides a steady, guaranteed income for life, helping protect you from both market ups and downs and the risk of outliving your savings. This reliability makes it a great option for covering essential costs like housing, utilities, and medical expenses. However, it does come with trade-offs, such as reduced access to your funds and limited options for passing money to heirs, especially with lifetime-only payment plans.

Your health, life expectancy, and comfort with risk all play a role in how valuable a lifetime income guarantee might be for you. Interest rates also matter – a higher rate means larger monthly payments. Additionally, taxes can vary depending on whether you buy the annuity using pre-tax retirement funds or after-tax money. These points can help guide you in deciding how an immediate annuity fits with your financial goals.

Next Steps for Financial Security

Now that you’re familiar with the basics, it’s time to take action. Start by reflecting on your personal situation – use the self-assessment questions from the earlier checklist. Be honest about your financial needs, health, and what you want out of retirement.

Next, consult a licensed annuity professional. They can help you see how an immediate annuity fits into your broader retirement strategy, including how it works with your Social Security benefits, retirement accounts, and other assets. They’ll also break down the different payout options and explain how these choices impact your income and what’s left for your beneficiaries.

Secure Stream Income offers helpful tools to prepare for these conversations. Their educational materials explain the basics so you can ask smart questions and feel confident evaluating recommendations. Through their platform, you can connect with licensed insurance agents across the country who are familiar with local rules and market trends.

As you move forward, think about how an immediate annuity fits into your overall retirement plan. A well-rounded strategy balances guaranteed income with room for growth and flexibility. For example, you might dedicate part of your savings to an immediate annuity while keeping other investments for liquidity and potential growth. The goal is to strike the right balance for your situation, giving you both financial security and peace of mind in your retirement years.

FAQs

How do immediate annuities compare to Social Security and investments in terms of reliability and flexibility for retirement income?

Immediate annuities are a solid choice for retirement income because they guarantee regular payments starting within 12 months of purchase. Unlike stocks or bonds, they aren’t affected by market ups and downs, which makes them a steady and predictable option for financial security.

Social Security is another dependable income source, backed by the U.S. government. However, its benefits can be influenced by inflation or changes in government policy over time. Meanwhile, investments like stocks and bonds offer more flexibility – you can adjust or withdraw funds as needed. But with that flexibility comes greater risk, especially during market declines.

Each option has its strengths: immediate annuities offer stability and predictability, Social Security provides consistent support with some policy risk, and investments allow for adaptability but come with less certainty.

What should I consider when choosing between lifetime payments and a period-certain payout for an immediate annuity?

When choosing between lifetime payments and a period-certain payout for an immediate annuity, it’s crucial to consider your financial priorities and personal situation.

With lifetime payments, you receive income for as long as you live, offering protection against the risk of outliving your savings. The trade-off? Monthly payments are usually lower compared to other payout options. On the other hand, period-certain payouts guarantee income for a set number of years – commonly 10, 15, or 20. These tend to offer higher monthly payments but come with an endpoint. If you pass away before the period ends, any remaining payments can go to a designated beneficiary.

When making your decision, think about factors like your health, life expectancy, and financial needs. Ask yourself: Do you value income security for life, or would you rather have larger payments over a defined timeframe? Weigh these considerations carefully to ensure your choice aligns with your retirement goals and long-term plans.

How can I protect my retirement income from the effects of inflation when using an immediate annuity?

To protect your retirement income from the effects of inflation, one option to consider is an inflation-adjusted annuity. This type of annuity is structured to gradually increase your payments over time, helping you keep up with rising living costs and preserving your purchasing power.

Another alternative is a fixed index annuity, which links your income growth to a market index. This approach offers the opportunity for income increases that align with inflation, while also safeguarding your principal. Both choices provide ways to help your income stay on track with rising expenses over the years.

Leave a Reply